How to debit and credit revenue from services

What are revenues? Revenues are the gross increase in owner’s equity resulting from business activities. Revenues increase owner’s equity. An advertising company earns revenues from the advertising services provided to its clients.

This post is part of the “how to debit and credit” tutorials that describe how to record accounting transactions. In the basic accounting tutorials, we use the transactions of Frontier Advertising Company (FAC). For simplicity, we assume that FAC uses accounting period of one month. Three levels of transaction analysis will be adopted (that is, the basic analysis, analysis using accounting equation, and debit-credit analysis). According to those analyses, you will easily understand how transactions are recorded in the general journal.

Index of how to debit and credit tutorial

- Investment by owner

- Purchase of equipment

- Unearned revenues

- Payment of rent expenses

- Insurance as prepayment and the adjusting entry

- Supplies purchase and the adjusting entry

- Withdrawal by owner

- Payment of salaries expense

- Service revenues

- What is depreciation

What is the meaning of revenues?

What are revenues? Revenues are the gross increase in owner’s equity resulting from business activities. Revenues increase owner’s equity. An advertising company earns revenue from the advertising services provided to its clients. Revenues usually result in an increase in an asset, such as cash, accounts receivable, notes receivable etc.

In a service company, we record service revenues when the services have been performed. In other case, we recognize unearned revenues (a type of liabilities) for cash received in advance for future services.

How to debit and credit service revenues?

On January 31, FAC receives $10,000 in cash from Eliza Company. The cash receipt is related to advertising services that have been provided in January.

Basic transaction analysis

Asset in the form of $10,000 cash arises. On the other hand, service revenue of $10,000 earned.

Accounting equation analysis

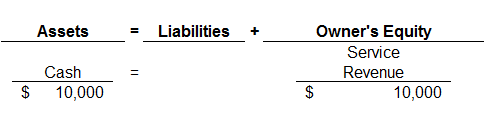

Accounting equation can be used to show the economic effects of an accounting transaction. It states that the total value of a company's assets must always equal the combined value of its liabilities and its owners' equity.

In our illustration, the effects of the increase in cash and the increase in owner’s equity (revenue) can be shown in terms of the accounting equation as follows:

Debit-credit analysis

According to the debit-credit rule, the increase in assets is debited. Since the cash is received from Eliza Company, we debit the Cash account $10.000.

According to the debit-credit rule, the increase in revenue is credited. The service has been performed in January. It means that the cash receipt has to be recorded as revenues for the current accounting period. Technically, the Service Revenue is credited $10,000.

Journal entry

Komentar

Posting Komentar